Bond Convexity Calculator

Bond Convexity Calculator

This online calculator is used to measure and manage the portfolios exposure to interest rate risk and risk of loss of expectation.

Results...

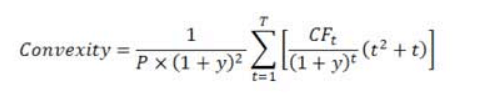

Formula for Bond Convexity Calculation :

Convexity is a measure of the curve in the relationship between a bonds price and a bonds yield, as it also takes into account the bonds duration. The duration measures the sensitivity of an asset in relation to external market forces, such as interest rates.

Where,

P - Bond Price

Y - Yield to maturity in decimal form.

T - Maturity in years.

CFt - Cash flow at time t.

Recommended Pages ►

Recommended Pages ►

How Much Future value is Worth Today

Gas Vehicle Savings Calculator

Mymathtables.com

If you like Bond Convexity Calculator, please consider adding a link to this tool by copy/paste the following code: